Powell's Fed likely to raise rates, may upgrade 2018 outlook

Dear Traders,

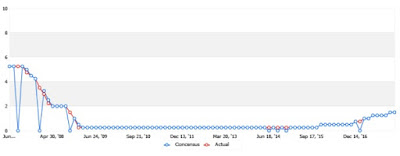

Mar 21, 18:00 GMT: The FOMC is expected to raise interest rates today at 18:00 (GMT) at its first policy meeting under new Chairman Jerome Powell.

The U.S. central bank has projected that it would increase rates three times in 2018, but experts believe that the current strength of the US economy could force an additional increase during the year. Officials have speculated that the stimulus could drive more Americans into an already tight labour market and lift inflation to the central bank’s 2 percent target, or above if the economy becomes too strong.

The Fed’s drive to recover from the 2007-2009 financial crisis and recession is nearing its completion; however, there are some concerns from analysts that any premature actions could have an adverse affect on the economy, especially with the lingering threat of a global trade war.

The overnight lending rate has already been raised three times last year due to joblessness falling and economic growth accelerating, and whilst the expectation is to raise rates by another 25 basis points today, it is possible that Powell's Fed could leave its rate unchanged until June to judge the how the economy absorbs the $1.8 trillion in stimulus expected from the Trump administration tax cuts and planned spending.

Volatility is expected before, during and after the decision is announced and traders should be aware that any significant changes in expected data can cause strong new trends and trading opportunities. Clients are reminded to properly manage equity levels for trading during high impact economic events.

*Please read the latest execution statistics report:https://www.yadix.com/Execution-speed/

Best regards,

David Bergman

Yadix Support Team

Yadix Forex Broker

Telephone: +44(0) 20 3239 6117

E-mail: support@yadix.com

Skype: yadix.forex

This comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDelete