Dear Traders,

The Federal increased interest rates on Wednesday by a 0.25% point and signaled that the central bank is likely to raise rates twice more in 2018.

Following the two-day policy meeting, it was announced that the economy continues to strengthen and the Fed expects to increase rates twice more this year as it targets a return to more normal interest rate levels as it was stated that “the economic outlook has strengthened in recent months.”

Powell, the new Fed chairman, expressed optimism about the economic picture and said officials were trying to strike a balance between raising rates too slowly or too quickly by targeting the "middle ground". The announcement underlines the Fed's confidence in the economy as well as its focus on the potential for inflation by increasing estimates for economic growth this year to 2.7 percent, up from 2.5 percent in December.

As this rate increases was well expected, it had already been priced in to the market, however speculation leading up to the announcement had suggested that the central bank would increase the interest rate four time this year, therefore the failure to indicate a fourth interest rate lead to a sharp recovery in many majors vs. the USD as well as sharp drops in US stocks.

The Fed's views have disappointed with the suggestion that 2018 will be targeted for normalization, with 2019 and 2020 projections raised, and with the impending risk of a trade war with global powerhouses, the markets have been left shaky with some experts claiming that the dollar needs a big surprise to be pushed higher. Therefore the general feeling is that the markets will be looking to upcoming date from different economic regions as crucial for the currency markets.

Best regards,

David Bergman

Yadix Support Team

Yadix Forex Broker

Telephone: +44(0) 20 3239 6117

E-mail: support@yadix.com

Skype: yadix.forex

Yadix a leading ECN/STP financial markets broker and provides direct to market order execution to 14 + liquidity providers with precision and lightening speeds, as such, Yadix welcomes all traders and strategies including expert advisors, Day Traders, Scalping and HFT strategies.

Thursday, March 22, 2018

Wednesday, March 21, 2018

Fed Interest Rate Decision

Powell's Fed likely to raise rates, may upgrade 2018 outlook

Dear Traders,

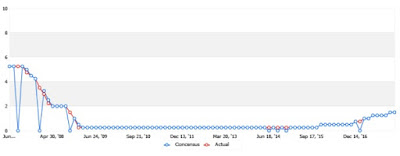

Mar 21, 18:00 GMT: The FOMC is expected to raise interest rates today at 18:00 (GMT) at its first policy meeting under new Chairman Jerome Powell.

The U.S. central bank has projected that it would increase rates three times in 2018, but experts believe that the current strength of the US economy could force an additional increase during the year. Officials have speculated that the stimulus could drive more Americans into an already tight labour market and lift inflation to the central bank’s 2 percent target, or above if the economy becomes too strong.

The Fed’s drive to recover from the 2007-2009 financial crisis and recession is nearing its completion; however, there are some concerns from analysts that any premature actions could have an adverse affect on the economy, especially with the lingering threat of a global trade war.

The overnight lending rate has already been raised three times last year due to joblessness falling and economic growth accelerating, and whilst the expectation is to raise rates by another 25 basis points today, it is possible that Powell's Fed could leave its rate unchanged until June to judge the how the economy absorbs the $1.8 trillion in stimulus expected from the Trump administration tax cuts and planned spending.

Volatility is expected before, during and after the decision is announced and traders should be aware that any significant changes in expected data can cause strong new trends and trading opportunities. Clients are reminded to properly manage equity levels for trading during high impact economic events.

*Please read the latest execution statistics report:https://www.yadix.com/Execution-speed/

Best regards,

David Bergman

Yadix Support Team

Yadix Forex Broker

Telephone: +44(0) 20 3239 6117

E-mail: support@yadix.com

Skype: yadix.forex

Friday, March 16, 2018

Expert Advisors with Verified Performance

Dear Trader

Have a look at verified performance (MyFxBook) of clients trading successfully using profitable EAs, we would like to share the statistics and allow you use those systems.

Performing Expert Advisors:

https://www.myfxbook.com/members/Gforex99/trueforex/2407731

https://www.myfxbook.com/members/tardell/profix/2425045

http://www.myfxbook.com/members/SolFx/trufx/2099921

http://www.myfxbook.com/members/GM2015/capitalpro/2270639

You can start to trade with any of these EAs immediately and with a qualifying deposit, benefit from: Free EA lifetime license, a Free VPS and trade on our leading ECN account.

Let us know if you'd like to join any of those programs.

Best regards,

Richard Lee

Yadix Support Team

Yadix Forex Broker

Telephone: +44(0) 20 3239 6117

E-mail: support@yadix.com

Skype: yadix.forex

Have a look at verified performance (MyFxBook) of clients trading successfully using profitable EAs, we would like to share the statistics and allow you use those systems.

Performing Expert Advisors:

https://www.myfxbook.com/members/Gforex99/trueforex/2407731

https://www.myfxbook.com/members/tardell/profix/2425045

http://www.myfxbook.com/members/SolFx/trufx/2099921

http://www.myfxbook.com/members/GM2015/capitalpro/2270639

You can start to trade with any of these EAs immediately and with a qualifying deposit, benefit from: Free EA lifetime license, a Free VPS and trade on our leading ECN account.

Let us know if you'd like to join any of those programs.

Best regards,

Richard Lee

Yadix Support Team

Yadix Forex Broker

Telephone: +44(0) 20 3239 6117

E-mail: support@yadix.com

Skype: yadix.forex

Tuesday, March 13, 2018

Specialist Service for Japanese Traders

Dear Clients,

We are happy to announce a regional partnership and a new service that offers specialist local services for Japanese traders.

Yadix Japan offers trading conditions, account types, promotions and local language support specifically for traders in the region.

All Japanese clients are invited to visit the new site and benefit from trading with Yadix Japan http://jp.yadix.com/

For more information, please feel free to live chat with our Japanese Support Team.

Best regards,

George Miller

Partners Team

Yadix Forex Broker

Telephone: +44(0) 20 3239 6117

E-mail: partners@yadix.com

Skype: yadix.partners

We are happy to announce a regional partnership and a new service that offers specialist local services for Japanese traders.

Yadix Japan offers trading conditions, account types, promotions and local language support specifically for traders in the region.

All Japanese clients are invited to visit the new site and benefit from trading with Yadix Japan http://jp.yadix.com/

For more information, please feel free to live chat with our Japanese Support Team.

Best regards,

George Miller

Partners Team

Yadix Forex Broker

Telephone: +44(0) 20 3239 6117

E-mail: partners@yadix.com

Skype: yadix.partners

Friday, March 9, 2018

New Service for Indonesian Traders

Dear Traders,

We are happy to announce a new regional partnership and a new service that offers specialist local services for Indonesian traders.

Yadix Indonesia offers trading conditions, account types, promotions and local language support specifically for traders in the region.

All Indonesian clients are invited to visit the new site and benefit from trading with Yadix Indonesia https://indo.yadix.com/

For more information, please feel free to live chat with our Indonesian Support Team.

Best regards,

George Miller

Partners Team

Yadix Forex Broker

Telephone: +44(0) 20 3239 6117

E-mail: partners@yadix.com

Skype: yadix.partners

We are happy to announce a new regional partnership and a new service that offers specialist local services for Indonesian traders.

Yadix Indonesia offers trading conditions, account types, promotions and local language support specifically for traders in the region.

All Indonesian clients are invited to visit the new site and benefit from trading with Yadix Indonesia https://indo.yadix.com/

For more information, please feel free to live chat with our Indonesian Support Team.

Best regards,

George Miller

Partners Team

Yadix Forex Broker

Telephone: +44(0) 20 3239 6117

E-mail: partners@yadix.com

Skype: yadix.partners

Non Farm Payrolls

The U.S Non Farm Payrolls will be released Friday, 9th of March 2018 13:30 GMT and is a key economic indicator that can cause volatility in the markets.

What to Expect this Month:

The markets expect the Nonfarm Payrolls to show that the U.S. economy added 200K jobs during February, the same number as in January. As the Labour market continues to show strength and global economy grows, the market expects another strong NFP report.

The average hourly earnings figures will be watched closely, in January the figure was 2.9%, however, many experts are forecasting a slight drop with February's figure to 2.8%. A bad NFP release with the unemployment rate rising above 4.1% should see the dollar come under pressure and a release of over 250K new jobs added and unemployment rate below 4.0% would add more strength to the dollar.

US President Donald Trump has announced tariffs on steel and aluminium imports, this has lead to "Trade Wars" fears and a immediate reaction from European and Asian leaders, who have threatened to pin-point US products for additional tariffs to in retaliation. The move from trump immediately prompted falls in global stock markets with German, French, UK, Hong Kong stocks slipping however the Japanese Nikkei suffered most and dropped 2.5%.

Opportunities around the NFP Reports:

Regardless of the results of the Non Farm Payrolls, the markets always experience moves immediately after the release which offer traders excellent short-term trading opportunities. Positive or negative reports will affect market sentiment which can create new trends and trading opportunities.

Follow the latest Forex news, market insights and Economic reports here: https://www.yadix.com/forex-trading-community/economic-calendar/

What to Expect this Month:

The markets expect the Nonfarm Payrolls to show that the U.S. economy added 200K jobs during February, the same number as in January. As the Labour market continues to show strength and global economy grows, the market expects another strong NFP report.

The average hourly earnings figures will be watched closely, in January the figure was 2.9%, however, many experts are forecasting a slight drop with February's figure to 2.8%. A bad NFP release with the unemployment rate rising above 4.1% should see the dollar come under pressure and a release of over 250K new jobs added and unemployment rate below 4.0% would add more strength to the dollar.

US President Donald Trump has announced tariffs on steel and aluminium imports, this has lead to "Trade Wars" fears and a immediate reaction from European and Asian leaders, who have threatened to pin-point US products for additional tariffs to in retaliation. The move from trump immediately prompted falls in global stock markets with German, French, UK, Hong Kong stocks slipping however the Japanese Nikkei suffered most and dropped 2.5%.

Opportunities around the NFP Reports:

Regardless of the results of the Non Farm Payrolls, the markets always experience moves immediately after the release which offer traders excellent short-term trading opportunities. Positive or negative reports will affect market sentiment which can create new trends and trading opportunities.

Follow the latest Forex news, market insights and Economic reports here: https://www.yadix.com/forex-trading-community/economic-calendar/

Thursday, March 8, 2018

Specialist Service for Malaysian Traders

Dear Clients,

We are happy to announce a new regional partnership and a new service that offers specialist local services for Malaysian traders.

Yadix Malaysia offers trading conditions, account types, promotions and local language support specifically for traders in the region.

All Malaysian clients are invited to visit the new site and benefit from trading with Yadix Malaysia http://my.yadix.com/

For more information, please feel free to live chat with our Malaysian Support Team.

Best regards,

George Miller

Partners Team

Yadix Forex Broker

Telephone: +44(0) 20 3239 6117

E-mail: partners@yadix.com

Skype: yadix.partners

We are happy to announce a new regional partnership and a new service that offers specialist local services for Malaysian traders.

Yadix Malaysia offers trading conditions, account types, promotions and local language support specifically for traders in the region.

All Malaysian clients are invited to visit the new site and benefit from trading with Yadix Malaysia http://my.yadix.com/

For more information, please feel free to live chat with our Malaysian Support Team.

Best regards,

George Miller

Partners Team

Yadix Forex Broker

Telephone: +44(0) 20 3239 6117

E-mail: partners@yadix.com

Skype: yadix.partners

Subscribe to:

Posts (Atom)